Annually, MHI — the industry association for supply chain and materials handling companies, of which DCS is a member — works with Deloitte to examine the latest trends and developments surrounding the adoption of innovative technologies. Their research includes a comprehensive survey of more than 1,000 executive leaders throughout manufacturing and supply chain operations from companies large and small. This year, the 2022 MHI Annual Industry report, “Evolution to Revolution: Building the Supply Chains of Tomorrow,” was released during MODEX at the end of March.

I’ve read the report every year of its publication over the past nine years (you can too, as each is a free download from MHI’s website). It provides not only an interesting perspective on where the industry currently stands in terms of supply chain trends, but also insights into what developments are most likely to occur next.

Of course, as everyone in the supply chain field knows, the pandemic had a dramatic impact on operations. If your friends, family, and neighbors didn’t understand your job in the supply chain or why it’s important, they definitely do now. According to the report, companies that previously disregarded their supply chain and distribution operations now hold them in much higher esteem: 87% of survey respondents said their companies now consider the supply chain to be strategically important.

Further, 78% say supply chain transformation through adoption of digital technologies has been accelerated due to COVID-19. Investment in these solutions is also on the rise, with 64% of those surveyed reporting increased spending plans, particularly among those who intend to spend between $5 million and $100 million.

The report has historically covered 11 technologies, querying survey participants about which ones have the greatest potential to transform day-to-day operations, projected adoption rates, and common barriers to adoption. They include:

- Artificial Intelligence (AI)

- Predictive analytics

- Inventory and network optimization

- Robotics and automation

- Wearable and mobile technology

- Driverless vehicles and drones

- 3D printing

- Internet of Things (IoT)

- Cloud computing and storage

- Sensors and automatic identification

- Blockchain

DCS doesn’t focus on technologies such as Blockchain, driverless vehicles and drones, or 3D printing. But nearly every system we design either incorporates or connects with one or more of these 11 solutions. Through that lens, a couple of the key findings from the 2022 MHI Annual Industry Report jumped out at me in particular.

More Accurate Forecasting A Top Goal

Looking out over the next five years, every technology listed was predicted by survey participants to achieve an adoption rate of 66% or higher. Of the 11, cloud computing has the highest current adoption rate at 40% and is expected to grow to 86% by 2027. It’s followed by inventory and network optimization, with an expected adoption rate of 87%. AI will be used nearly five times more than it is today, jumping from 15% adoption in 2022 to 73% in 2027. Finally, predictive analytics, currently at 22%, is forecast to grow to 82% over the next five years.

Overall, these numbers didn’t surprise me that much. Cloud computing has become the de facto standard for virtually all supply chain software deployments, far preferred over software hosted on-premises. Updates, maintenance, and vendor support are easier to obtain with remote hosting, and the pricing models are more appealing. As Internet networks continue to expand, bandwidths grow, and speed increases, it makes sense that the Cloud will be leveraged more and more.

The other three technologies — inventory and network optimization, AI, and predictive analytics — were prominently featured by exhibitors of all sizes at MODEX 2022. Whereas in the past there were a lot more demos of physical material handling equipment on the show floor, this year there was considerable real estate dedicated to software solutions that help organizations gain a better grasp of the unknown.

That makes a lot of sense in an era where disruption is the new normal in supply chains. Indeed, the 2022 MHI Annual Industry Report found that supply chain disruptions and shortages were the leading top challenge for 57% of survey participants. The pandemic fallout — transportation delays, port congestion, capacity limitations, inventory shortages, excessive lead times, wildly unpredictable customer demand spikes, and intense competition — has supply chain consultants scrambling to stay ahead of the next unexpected development. Companies are looking for solutions that can help them get a better grasp on the timing of their upstream supply chain overlaid against their own business and inventory forecasts.

One way inventory and network optimization, AI, and predictive analytics are being leveraged is through digital twin supply chain simulations. This is a type of software that allows operations managers to recreate their physical supply chain in a virtual space. There, they can modify parameters to test the resilience of their supply chains in the face of different challenges: shifting customer demands, catastrophic weather events, political upheavals, raw materials shortages, tax or tariff increases, worker strikes, and so on.

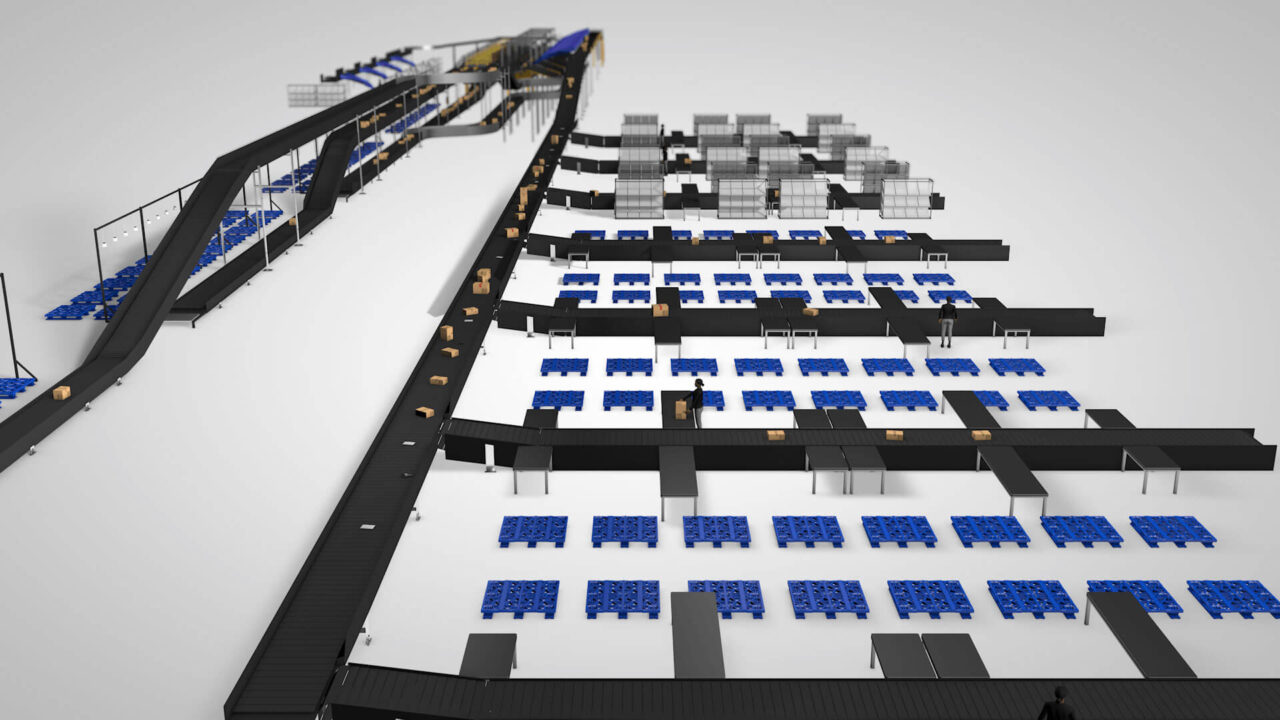

Additionally, other types of digital simulations are also on the rise. At DCS, we are increasingly recommending customers run our design proposals — particularly those that incorporate automation — through digital system simulations. These verify the system’s performance based on the inventory and productivity forecasts provided by the customer. They can also be used to test different scenarios and future expansion plans.

Further, I’ve seen some of our customers utilize digital simulators that replicate a work task or job, like driving different types of forklifts or interfacing with an automated goods-to-person picking system. Some use them for training new hires; others are offering applicants the opportunity to try the job in a simulator to get a feel for it and better gauge their interest in the position as part of the screening process.

Robotics and Automation Investments Address Workforce Shortages

Speaking of workers and automated technologies, survey respondents report that robotics and automation solutions are currently in use at 28% of their operations, a number expected to reach 79% in five years. Those technologies are also at the top of the list of innovations believed to have either the potential to disrupt the industry (17%) or to create competitive advantage (39%).

The reasons for this anticipated growth are partly to improve supply chain agility and efficiency, but perhaps more crucially to reduce operations’ reliance on manual labor to perform repetitive tasks. Hiring and retaining workers continues to be near the top of the report’s list of ongoing supply chain challenges faced by operations at 54%.

That finding didn’t surprise me either. It’s something we hear from our customers every day. In fact, one customer in our region of middle Tennessee recently told me that collectively — across all employers in their area — there are three job openings for every person who lives there. They simply can’t find enough people to fill open positions, and are faced with constant competition to offer the best compensation for that skill set.

By implementing automation, including autonomous mobile robots (AMRs) which were showcased in many MODEX exhibits, companies are no longer making a business case based on a reduction in headcount. Instead, they’re focused on how automated technologies can bolster employee attraction and retention by making the jobs easier, less physically taxing, and more enjoyable overall. That shift in investment motivation itself has been a significant supply chain transformation that the report’s authors and I believe will continue moving forward.

What did you think about the 2022 MHI Annual Industry Report? I’d love to hear your thoughts. Connect with us.

Author

Curtis Jefferson, Vice President of Sales & Marketing, curtis@designedconveyor.com

Curtis Jefferson serves as the Vice President of Sales and Marketing of Designed Conveyor Systems and leads his team with passion and over 16 years of experience in the material handling industry.

Curtis received his Bachelor of Science in Industrial Engineering from the Georgia Institute of Technology and immediately began his career in the material handling industry. He has since served in many roles including, supply chain management, systems engineering, and business development and sales.

Outside of the office, you can find him spending time with his family and pets in the great outdoors!