This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Record-Breaking Holiday Surge Tests DCs — Why Fulfillment Systems Must Be Future-Proof

By Megan Taylor, Marketing Manager, Designed Conveyor Systems (DCS)

Holiday retail in 2025 didn’t just deliver — it exploded. The five-day shopping binge from Thanksgiving through Cyber Monday redefined “peak season,” creating an order surge few fulfillment centers were truly prepared for. For companies operating distribution centers, warehouses, or e-commerce fulfillment, the result was a stress test. For those thinking ahead: a wake-up call.

Here’s how the numbers break down:

- According to recent reporting from Adobe, U.S. online spending during the Thanksgiving-to-Cyber Monday stretch surged to $44.2 billion, including a record $14.25 billion on Cyber Monday alone. That’s a 7.7% increase over last year — surpassing pre-holiday forecasts.

- Meanwhile, Black Friday set new records. Consumers spent $11.8 billion online, making it one of the biggest single-day e-commerce events in U.S. history.

- Adobe’s broader 2025 holiday season forecast also projected that total U.S. online sales for November–December will surpass $253.4 billion, up 5.3% year-over-year.

- At the same time, in-store retail remains active. A recent report from retail analytics firm pass_by shows a modest 1.17% year-over-year increase in in-store visits for Black Friday 2025, signaling that physical retail is still part of the omnichannel mix.

That kind of volume — online or omnichannel — exerts enormous pressure on distribution centers (DCs). For fulfillment operations, a record-setting season means tight shipping windows, higher throughput, more frequent replenishment, and an even steeper post-holiday returns surge.

This surge underscores the importance of a well-integrated fulfillment system. Put simply, if a DC isn’t engineered for this level of demand, critical processes will fail.

What the Surge Means for DC Operations

This year’s holiday surge pushed nearly every aspect of retail distribution and fulfillment to its limits. Throughput and fulfillment demand rose sharply as higher online order volume translated directly into increased picking activity, heavier outbound shipping, and tighter processing windows.

At the same time, inventory and replenishment teams felt significant pressure. Fast-turn inventory — especially promotional items — moved quickly. Without optimized slotting or well-designed replenishment workflows, many facilities risked stockouts, mispicks, or labor-intensive rework.

The season also introduced greater variability and unpredictability into order profiles. A mix of promotions, category spikes, and changing shopper behavior made stock keeping unit (SKU) velocity harder to forecast, increasing the importance of accurate case, pallet, and each-level planning.

Meanwhile, the widening split between online and in-store activity reinforced the need for DCs to prioritize e-commerce fulfillment capacity, even as omnichannel replenishment remains essential for retailers with physical footprints.

And looming behind the record sales is the next operational wave: returns. High sales almost always lead to high return rates in January, meaning many DCs are preparing for a second surge in volume that will hit just as seasonal labor contracts and staffing stabilizes.

For many operations, this holiday season amounted to more than just a temporary spike. It served as a stress test, revealing where software, controls, storage solutions, and core processes performed well and where they may need strategic, integrated fulfillment system upgrades before next year’s peak.

Why Now Is the Time for Fulfillment Review & Upgrades

For DCs that survived — or even thrived — this holiday bonanza, the question becomes: are you ready for next time? For those that struggled, now is the window to rebuild. Here are key evaluation areas:

- Validate throughput versus storage data. Use your real order/data logs from the holiday peak — orders/day, units/line, SKU mix — to understand actual demand and compare to baseline assumptions.

- Examine layout and slotting under peak loads. Did pick paths get congested? Were replenishments frequent? Were there bottlenecks in staging, packing, or shipping lanes?

- Assess controls, software, and automation capacity. Manual or outdated systems may not scale. Automated fulfillment systems, warehouse execution software (WES), and adaptive controls help absorb peak demand while reducing error and labor strain.

- Plan for the returns season. Returns may spike in January. Without proper planning, they can overwhelm fulfillment operations, negating revenue gains from holiday sales.

- Build flexibility and scalability. Consumer behavior changes rapidly. Today’s peak may be eclipsed next year. Infrastructure — both physical and digital — should be designed to scale up or down efficiently.

How DCS Can Help Turn Peak Pressure into Future Resilience

At Designed Conveyor Systems (DCS), those challenges are exactly why many of our clients engage us right after peak season. Our team helps by:

- Validating and analyzing peak-season data. DCS engineers take your order history, throughput logs, SKU data, and usage profiles to build a clear picture of stress points, capacity limits, and operational bottlenecks.

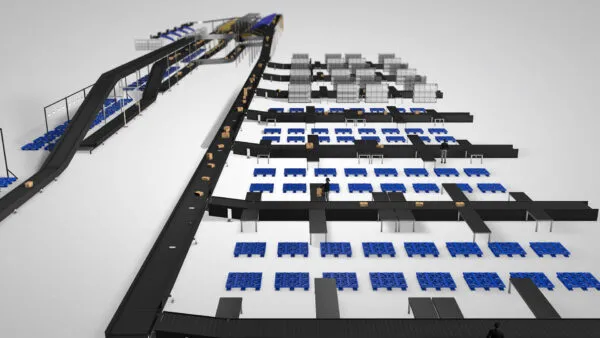

- Re-evaluating facility layout and flow. Work with DCS on optimizing slotting, pick/pack paths, buffer zones, and storage density to handle peak and off-peak efficiently. This is especially important for retail distribution industries like home improvement, sporting goods, and footwear.

- Upgrading controls, software, and automation. DCS helps operations leverage a modern warehouse execution system (WES), integrated controls, and automated fulfillment systems that can scale rapidly for high volume, while remaining flexible during slower periods.

- Planning for returns and volatility. Let DCS help design flexible workflows and adaptive infrastructure, so a surge of returns doesn’t become a bottleneck.

- Future-proofing the operation. Work with DCS to verify that existing layout, software, and systems are scalable and maintainable for multiple peak seasons, helping protect ROI and improve responsiveness.

With data from this record-breaking season in hand, DCS can help turn what was a “survival mode” into a structured roadmap for long-term operational resilience and profitability.

What Comes Next: Returns, Data Review, and Strategic Upgrades

The record-breaking Black Friday to Cyber Monday surge was more than a retail milestone. It was a behind-the-scenes stress test for every fulfillment center. If your operation performed smoothly, that’s a win. If it struggled, stalled, or exposed systemic gaps, consider it a signal — and an opportunity.

As return volumes peak and overall order activity settles back into normal patterns, operations enter the most valuable phase of the annual fulfillment cycle: the post-season review.

This is the ideal time to evaluate performance, without the noise of peak-season chaos. Examining historical data, throughput patterns, system behavior, and labor utilization reveals what worked well, what strained the operation, and where bottlenecks or inefficiencies surfaced under pressure.

That insight becomes even more powerful when paired with strategic upgrades. Enhancements in software, controls, storage systems, and facility layout can transform this year’s pain points into next year’s strengths. Retail facilities that proactively modernize with automated fulfillment systems — rather than waiting until the next surge exposes the same weaknesses — position themselves to enter 2026’s peak season with greater speed, flexibility, and resilience.

Ready to turn this year’s pressure into next year’s competitive advantage? Connect with DCS to learn how we can support your post-holiday facility assessment and modernization plan.